Cartoon

-

Execution impresses as sovereign found itself in sub-par market conditions

-

Want to reform the GSEs and create a US covered bond market? You're hired

-

◆ UK lender deal beats expectations amid limited competing supply ◆ Issuing in euros was cheaper than sterling ◆ Italy's BFF Bank returns to bond market but pays more than in April

-

◆ Dual-tranche deal attracts €200bn of orders ◆ New seven year was somewhat unexpected ◆ Bookbuilding started with 4bp of premium

-

European corporate bond issuers that still have deals to do can relax a little

-

◆ Portuguese lender attracts 'absolute' spread buyers ◆ Pricing seen flat if not inside fair value ◆ Appetite for 'underweight' Portuguese risk helps

-

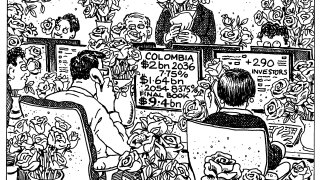

Bloc prices another blockbuster after launching repo facility as it adapts to shifting relative value in pursuit of sovereign status

-

Investors feasted on the first international bond from the global mining giant

-

Rachel Reeves's first Budget needs to pass the Truss test and avoid spooking the Gilt market

-

◆ German bank brings dollar AT1 after June's euros print ◆ Potential UniCredit takeover partially factored into pricing ◆ Deal offers premium to European peers

-

Borrowers should show more discipline if they don’t want to risk undermining all the investor work they have done

-

Uzbek bank eyes bigger, brighter future in capital markets