BNP Paribas

-

Hires come as BNP Paribas climbs UK ECM league table

-

Barclays has poached the co-head of BNP Paribas’s team

-

-

◆ French bank's insurance arm is a very rare issuer in the open market ◆ New RT1 is a public deal but done as a 'restricted placement' ◆ Refinances a call on €1bn tier one from 11 years ago

-

-

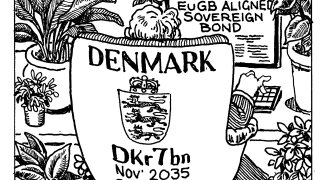

Sovereign achieved ‘significant milestone’ but market participants hope to see more

-

◆ Sole management enables quick sale ◆ Debate on fair value but some concession left ◆ Big green bond comes between two SNP redemptions

-

Barclays wants to emulate BNPP's success in Nordic region

-

-

French risk ‘the known unknown’ and will ‘get serious' come autumn

-

Banker left US house and joined boutique in 2023

-

Long time staffers handed expanded remit