Banks

-

◆ No new issue premium paid ◆ Green bond helps build book ◆ Good demand for French agencies

-

◆ First euro deal from Candian province hits 'perfect storm' ◆ BNG and AFD print 15 years ◆ All tighten by at least 3bp

-

◆ Four issuers out in dollars, three in the same maturity ◆ Swap spread moves foil tightening potential ◆ Deals getting done, but market isn't 'white hot'

-

◆ Value versus domestic curve debated ◆ Scarce Nordic tier two supply helped trade ◆ Nordic names 'still performing during volatility'

-

◆ New euro deal more than 6.5 times subscribed ◆ Comes one trading day after a call and non-call decision on two dollar AT1s ◆ Visible new issue premium helps attract orders

-

◆ Swedish issuer starts tight ◆ Deal lands close to recent SSA supply ◆ Seven year tenor offers investors something different

-

◆ Managing the go-no go call ◆ 'Granular' conversations on social label ◆ AT1 redemptions and offsets in balance sheet

-

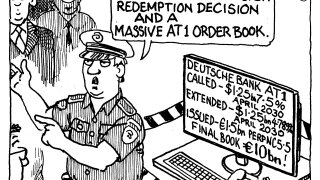

◆ Deutsche Bank calls one AT1, extends another ◆ Market appears accepting to 'idiosyncratic' event ◆ Metro Bank issues public AT1 with the highest coupon

-

Move follows hiring of John Kolz as co-head of global ECM

-

◆ Three banks raise dollar funding with single digit premium ◆ ING moved through 'right window' to issue its first Yankee of year ◆ NatWest opts for four-part opco print

-

HSBC’s investment bank could have a new strategy this month after negotiating a stay of execution from the CEO for parts of M&A and ECM. But the truncated bank will have a harder time convincing clients

-

◆ Investors flock to tightly priced trade ◆ Next to no premium paid ◆ Sparebanken Vest is still to come