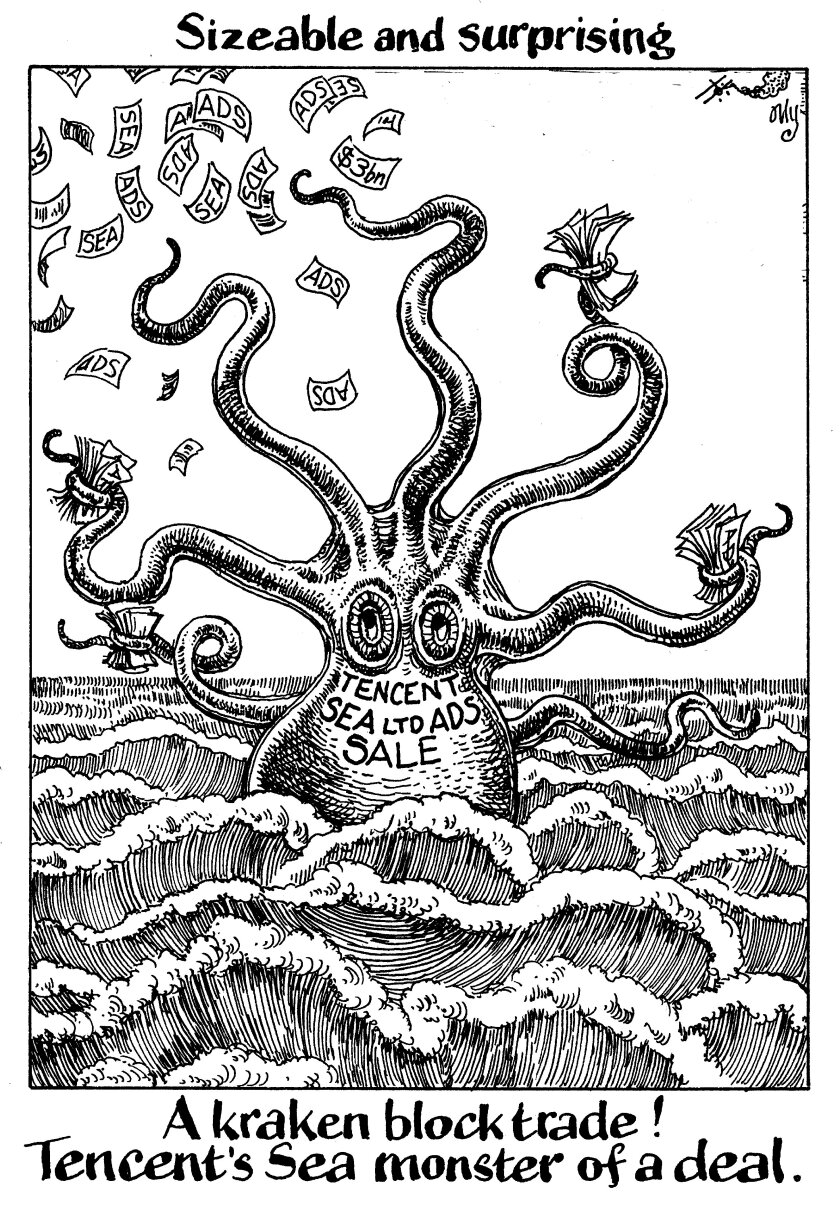

Tencent’s tight loan price forces banks to balance return against relationship

Tencent Holdings is testing bank appetite for a jumbo loan of $6bn as it gets ready to once again shun syndication in favour of a club deal. But the razor-thin pricing on offer is likely to pose a challenge — as will a recent crackdown on some of China’s largest technology companies. Pan Yue reports.

Unlock this article.

The content you are trying to view is exclusive to our subscribers.

To unlock this article:

- ✔ 4,000 annual insights

- ✔ 700+ notes and long-form analyses

- ✔ 4 capital markets databases

- ✔ Daily newsletters across markets and asset classes

- ✔ 2 weekly podcasts