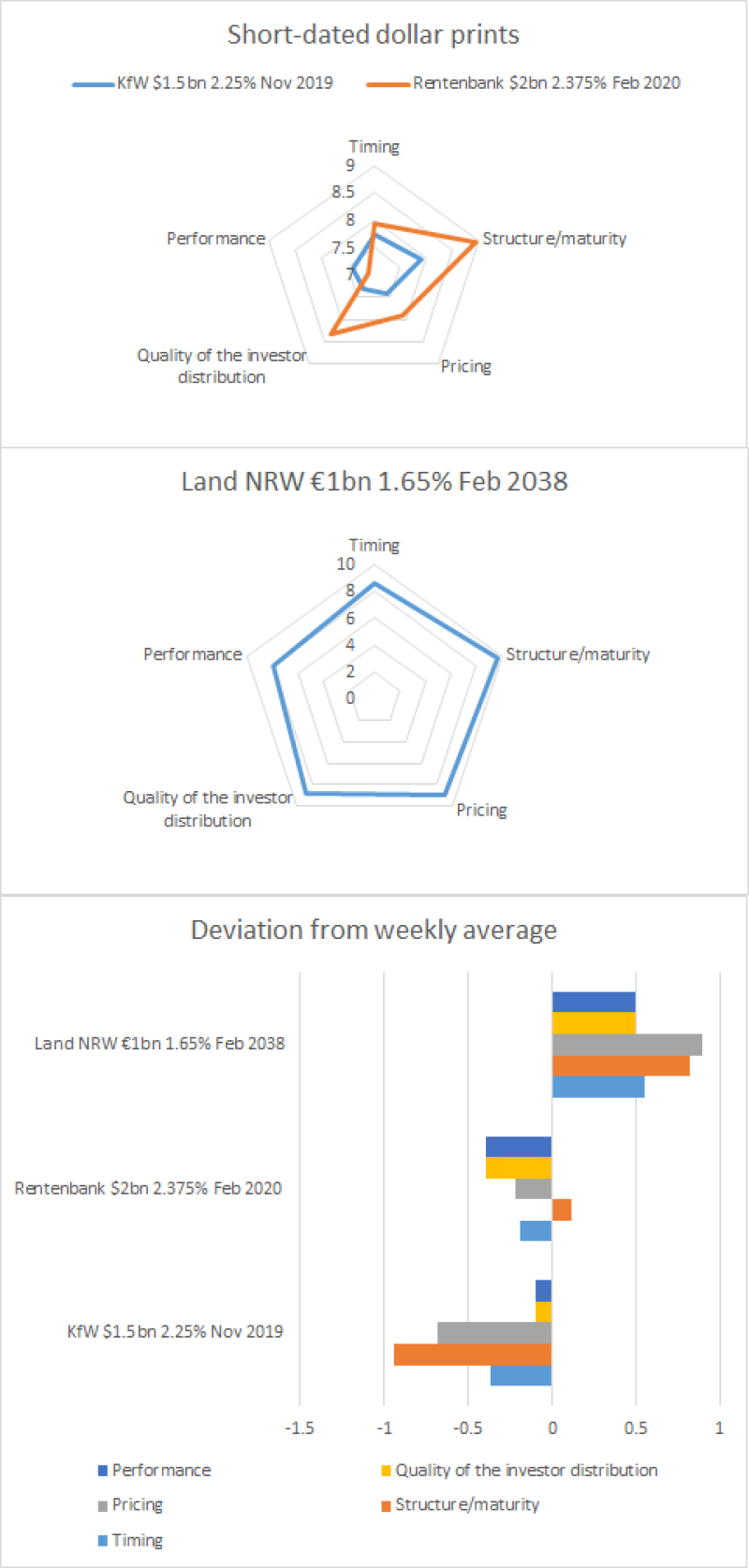

The top scoring deal of the week beginning February 12 was a €1bn 20 year effort from Land NRW — the longest Land benchmark since October. Voters gave the 1.65% February 2038, led by Bank of America Merrill Lynch, Deutsche Bank, JP Morgan and Nord LB, an average score of 8.82.

The choice of structure/maturity particularly resonated with voters — Land NRW’s deal was awarded 9.67 in that category. The last Land benchmark of 20 years or longer was a €1bn 1.75% 40 year from the same borrower in October.

Land NRW deal’s lowest score was for performance, with 8. The deal attracted a book of €2bn (including €300m for the leads).

A pair of short-dated dollar deals from KfW and Rentenbank achieved decent average scores, but were slightly less popular with voters.

KfW’s $1.5bn 2.25% November 2019 had an average score of 7.56 while Rentenbank’s $2bn 2.375% February 2020 had 8.04.

Rentenbank’s deal scored highly in the structure/maturity category (8.96), but less well in performance (7.11). KfW’s highest scores were also in the structure/maturity category (7.91), but is lowest was in quality of the investor distribution (7.32).

Deutsche Bank, Goldman Sachs and Morgan Stanley led KfW’s deal, while Bank of America Merrill Lynch, BNP Paribas, Goldman Sachs and RBC Capital Markets led Rentenbank’s.