Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

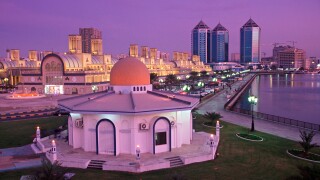

Gulf investors 'will now look at every deal', whether sukuk or not

Demand from the Middle East for the sukuk was steady

Bond pricing for the mining company started about 43bp back of its parent

Sovereign wealth fund takes $2bn, as aimed at

More articles/Ad

More articles/Ad

More articles

-

The deal has not been pulled or put on hold, said sources involved

-

Very little — if any — premium left for the Public Investment Fund, a major shareholder

-

The company trades tight to its parent, the Oman government

-

They contributed to a monster week for CEEMEA issuance

-

Sovereign gets bigger size and longer tenor in dirham despite closing market

-

Tuesday's 7.5 year sukuk will be the sovereign's second auction