Yen

-

French bank is a force in covered and overseas unsecured issuance

-

◆ ¥50bn Euroyen is issuer's first public bond in currency for five years ◆ Wide range of investors buys what was the biggest foreign issuer in yen ◆ Pricing wider than euros, tighter than dollars

-

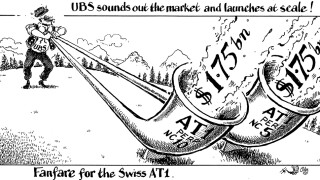

In a year dominated by the collapse and takeover of Credit Suisse, financial institutions were keen to re‑establish investor confidence in some of the riskier asset classes. Axa led the way just weeks after the CS rescue with a €1bn subordinated bond. In the autumn, UBS made a bold statement about the stability of Swiss bank capital as it returned to AT1 issuance with two $1.75bn tranches. Elsewhere, banks dealt with tricky conditions and pulled off some skilfully timed transactions, underlining the market’s faith in mainstream currencies and emphasising the appeal of ESG labels

-

Second foray into Samurai market this year

-

Up to seven potential tranches will be priced on Thursday

-

G-SIBs looking at stable yen funding should consider clarifying their senior preferred documentation to expand investor access amid rising funding costs

-

Almost a year after becoming the first Canadian bank to issue tier two in yen, BNS is back for more

-

◆ French bank issues SP yen bonds for the first time in at least four years ◆ Deal attracts investors previously unable to buy ◆ May form a template for other European banks

-

◆ French bank raises ¥167bn thanks to loyal investors ◆ Its regular visits in the Japanese market are rewarded ◆ Cross-border yen issuance resilient in the face of rates volatility

-

Policy lenders say they are monitoring yen pricing after South Korea’s debut

-

The sovereign's debut issuance could encourage other issuers from the country

-

◆ NAB chooses faster Euroyen while BNP Paribas goes bigger in Samurai ◆ French deal showed greater 'depth' of domestic market ◆ Low premium paid