UK Sovereign

-

Sterling is set to take a bigger slice of the socially responsible bond market as a result of a number of initiatives, including reforms that are putting the pressure on UK pension funds to focus on environmental, social or governance (ESG) factors in their investments. Burhan Khadbai reports

-

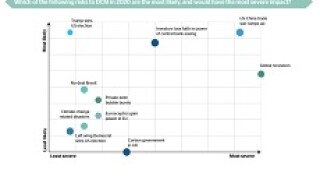

Markets go into 2020 fretting about a global recession and an escalation of tradetensions between the US and China, according to 25 heads of debt capital markets in the EMEA market, in Toby Fildes’ annual outlook survey. Respondents are mildly pessimistic on spreads and fees in the primary markets as well. But on the plus side, bankers are feeling hopeful about sustainability-themed bonds and almost unanimously believe issuance will top $270bn.

-

Equities are at record highs, rates at record lows; the US is quarrelling, China is slowing. As 2020 begins, participants are divided on which way markets will move. Toby Fildes picks 10 themes

-

Voters go to the polls on Thursday to pick the next UK government, with the outside possibility of a far left Jeremy Corbyn-led Labour government keeping capital markets bankers awake at night. But the return of Marxism might hold some silver linings for them.

-

The UK Debt Management Office (DMO) has announced the timing of the fifth and final syndication of its financial year.

-

-

The sterling public sector bond market was alive on Tuesday as the UK sold the penultimate syndication of its financial year and Caisse des Dépôts et Consignations returned to the currency for the first time since January 2018.

-

The wave of UK local authorities set to enter capital markets after the central government started charging them more for borrowing began to break this week as Redbridge Council raised £75m through a deferred bond. In doing so, it achieved better costs of funding from the market than it would from the Public Works Loans Board. More councils are set to follow.

-

Redbridge Council raised £75m through a deferred bond this week. A banker close to the deal said other local authorities would be following close behind.

-

The UK Debt Management Office has chosen the banks to lead the re-opening of its 0.125% 2041 index-linked Gilt, which is scheduled to take place next week.

-

The UK Debt Management Office will in November sell the fourth of five planned Gilt syndications during its 2019/20 financial year.

-

The Public Works Loans Board has given investment banks and asset managers the Christmas present they have been praying for for years. By hiking the cost of loans to local authorities, it will force them into private capital markets. Big mistake.