Top Section/Ad

Top Section/Ad

Most recent

Marco Ferrari joins Stockholm office from Nordea

One major bank has underwritten three infra deals in the last week

Agreement includes accordion facility

Flooring company's bespoke 'super senior funding' was done away from the syndicated loan market

More articles/Ad

More articles/Ad

More articles

-

Outokumpu, the Finnish stainless steel maker, has extended the maturity on the bulk of its bank loans, becoming the latest company to push its debt maturities out to a time when the world economy is expected to be well into a recovery.

-

In November, GlobalCapital polled loan market participants for its 18th Syndicated Loan and Leveraged Finance Awards. The nominations are listed below, in alphabetical order. We will reveal the winners at a virtual event in February. Further details on the event will be laid out on our website in January. We congratulate the nominees.

-

In early July, a cub reporter who had only left university the year before filed a story that would cause UK fast fashion company Boohoo’s share price to tumble.

-

Trig, the London-listed renewable infrastructure investment firm, has signed a £500m loan with its margin linked to Sonia rather than Libor, as loans bankers try to encourage borrowers look at their loan documents soon to avoid bottlenecks next year.

-

After four years of the US government noisily refusing to protect humanity from climate change and pushing back on responsible investing, sustainable finance supporters are full of hope that Joe Biden’s presidency will shift the US — and the world — in the right direction. Jon Hay reports

-

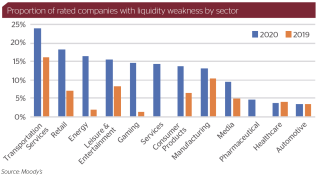

The coronavirus has smashed the usual hierarchy of companies, large and small, creating new winners — and many losers. While 2020 was about finding ways to keep their financial lifeblood flowing, in 2021, more permanent solutions will need to be found. This will include bond funding for those still shut out — and M&A. Mike Turner reports.