Top Section/Ad

Top Section/Ad

Most recent

Bankers say deals are still being launched and believe international rivalry can be negotiated

Banks accept some deals will bypass them — others they can intermediate

Sectors shape up as main sources of corporate syndicated lending demand amid renewed geopolitical uncertainty

New twist in Hollywood acquisition as Netflix adds $5bn revolver and $20bn of term loans

More articles/Ad

More articles/Ad

More articles

-

Trig, the London-listed renewable infrastructure investment firm, has signed a £500m loan with its margin linked to Sonia rather than Libor, as loans bankers try to encourage borrowers look at their loan documents soon to avoid bottlenecks next year.

-

Debt was the answer to every problem in 2020, as companies tried to survive the coronavirus pandemic. Dusty revolving credit facilities that had never been touched were fully drawn, firms begged from governments, those that could flocked to the bond market. Now, with hope of the crisis easing, there is an awful lot of debt to clear up. Mike Turner reports.

-

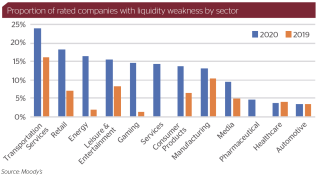

The coronavirus has smashed the usual hierarchy of companies, large and small, creating new winners — and many losers. While 2020 was about finding ways to keep their financial lifeblood flowing, in 2021, more permanent solutions will need to be found. This will include bond funding for those still shut out — and M&A. Mike Turner reports.

-

Cheesemaker Groupe Bel’s landmark US private placement under French law was funded this month. The company has sampled all the major sources of investment grade private capital in the recent past, having issued euro PPs and Schuldscheine before its new US PP.

-

This year proved to be one of the most dramatic on record for corporate financiers as volumes rose from the ashes of the market sell-off. David Rothnie examines some of the themes that defined the year and looks ahead to 2021.

-

Credit Suisse has hired Deutsche Bank’s head of corporate broking to bolster its senior UK investment banking team.