Top Section/Bond comments/Ad

Top Section/Bond comments/Ad

Most recent

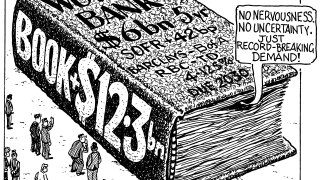

◆ Issuer's first green benchmark in 2026 ◆ Blended premium estimated ◆ Central bank/official institution allocations 'notable and high' for green label

◆ 'Impressive' and 'blockbuster' gush rival bankers ◆ Consensus on new issue premium ◆ Final deal size was amended

◆ Investor demand for 10 year dollars continues ◆ Secondary markets keep tightening ◆ Real money place structural bets in long end

Canada throwing full weight behind plan for new multilateral lender for defence funding

More articles/Ad

More articles/Ad

More articles

-

Deal was among MDB bonds warmly welcomed by investors this week

-

Investor demand for longer paper allows both issuers to price tight

-

Pragmatism to the fore for issuers trying to price benchmarks in turbulent markets

-

◆ First new benchmark from the issuer in two months ◆ Record IOIs but pragmatism remains ◆ Investors welcome MDBs back in primary after recent Trump noise

-

◆ Priced off recent peer issue ◆ New levels found after swap spread moves ◆ Deal twice subscribed

-

◆ Larger-than-expected green bond launched ◆ Issuer takes advantage of much calmer market this week ◆ Dollar benchmark could come before summer