Top Section/Bond comments/Ad

Top Section/Bond comments/Ad

Most recent

◆ Issuer's first green benchmark in 2026 ◆ Blended premium estimated ◆ Central bank/official institution allocations 'notable and high' for green label

◆ 'Impressive' and 'blockbuster' gush rival bankers ◆ Consensus on new issue premium ◆ Final deal size was amended

◆ Investor demand for 10 year dollars continues ◆ Secondary markets keep tightening ◆ Real money place structural bets in long end

Canada throwing full weight behind plan for new multilateral lender for defence funding

More articles/Ad

More articles/Ad

More articles

-

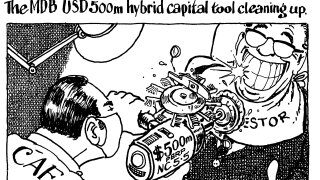

Bank intends to issue more hybrid capital but ‘more MDBs need to print’ for new asset class to grow further

-

◆ Takes larger size than expected ◆ Tightens 3bp to leave minimal premium ◆ French issuers fairly well funded before the summer

-

◆ Record book for an EIB EARN ◆ Demand supports ‘comfortable’ 3bp tightening ◆ Positive backdrop as SSA spreads perform in secondary

-

Issuer aims to stay active in core maturities and has now done three and 10 years in 2025

-

◆ LatAm development bank adds to funding toolkit ◆ Patience is virtue as issuer waits out tariff storm ◆ Book ended up 6.4 times covered

-

◆ Hesse prints largest European regional green bond ◆ ESM builds 'massive' book ◆ CDP tightens pricing by 6bp