Top Section/Ad

Top Section/Ad

Most recent

First Canadian province to visit euros in 2026

◆ Cautious start after spreads moved around ◆ KfW's spread tightens, but Länder unmoved ◆ ‘Real’ Länder-KfW spread yet to be established

German sovereign goes for conventional over green as smaller peers join a crowded Tuesday

Primary market shows strength but pockets of weakness a reminder that ‘1bp could make all the difference’

More articles/Ad

More articles/Ad

More articles

-

Cassa del Trentino has showed one of the major advantages of nurturing a medium term note programme by nipping in to take advantage of a one day rally in Italian government bonds to save precious basis points on its funding costs. As a small, infrequent issuer, the borrower showed some of its peers what can be achieved by taking the MTN route.

-

The City of Ludwigshafen has hired banks to run a roadshow for what will be its debut syndication. Meanwhile, City of Berlin picked banks to lead a deal that is set to be priced on Wednesday.

-

The Province of Trento’s funding arm Cassa del Trentino came to market early with a long dated medium term note to take advantage of strong performance in Italian government bonds. Meanwhile, Cassa Depositi e Prestiti mandated banks for a roadshow.

-

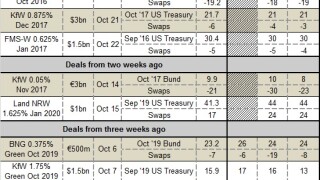

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Italian SSAs drew a mixed bag this week, as one sub-sovereign outlined plans for a long dated deal, while the Italian government’s borrowing costs rose in a series of auctions except a sale of 10 year debt — which only the vagaries of the repo market kept in check.

-

As the Canadian financial sector and provinces strive to create a North American renminbi hub within the sovereign’s borders, SSA issuers from the country have shown their support for the currency by returning to the dim sum market with a bang.