Top Section/Ad

Top Section/Ad

Most recent

First Canadian province to visit euros in 2026

◆ Cautious start after spreads moved around ◆ KfW's spread tightens, but Länder unmoved ◆ ‘Real’ Länder-KfW spread yet to be established

German sovereign goes for conventional over green as smaller peers join a crowded Tuesday

Primary market shows strength but pockets of weakness a reminder that ‘1bp could make all the difference’

More articles/Ad

More articles/Ad

More articles

-

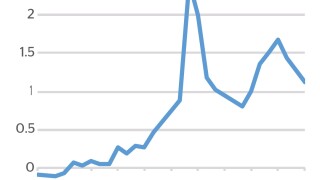

The recent swings in the sovereign, supranational and agency bond market due to political turmoil in Italy suggest issuers will have to change the way they execute deals in the coming months. Elsewhere, eyes are still trained on the European Central Bank’s tapering plans, while rising dollar yields are failing to attract SSA investors. Jasper Cox reports.

-

CPPIB Capital will sell its first ever green bond this week, coming on the heels of a French region’s foray into green and sustainability bonds.

-

-

-