Top Section/Bond comments/Ad

Top Section/Bond comments/Ad

Most recent

Inaugural government deal could come in late 2026 or early 2027

◆ New 20 year Bund launched into popular demand ◆ Is 20 years the new 30 years for EGBs? ◆ Fair value in debate

German sovereign goes for conventional over green as smaller peers join a crowded Tuesday

issuer identifies 'most important' syndication metric amid rising international interest

More articles/Ad

More articles/Ad

More articles

-

Euro SSA market rebuilds after recent volatility

-

French issuer postpones deal as compatriots set to face wider spreads

-

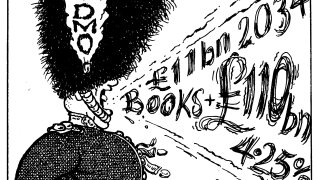

£110bn book proves ‘gradual but structural shift’ in demand to shorter tenors

-

'Textbook execution' lands sovereign issuer 'blowout deal'

-

Whether Germany pushed investors too far this week was of secondary importance

-

Market split over whether the issuer pushed pricing too far