Top Section/Bond comments/Ad

Top Section/Bond comments/Ad

Most recent

Inaugural government deal could come in late 2026 or early 2027

◆ New 20 year Bund launched into popular demand ◆ Is 20 years the new 30 years for EGBs? ◆ Fair value in debate

German sovereign goes for conventional over green as smaller peers join a crowded Tuesday

issuer identifies 'most important' syndication metric amid rising international interest

More articles/Ad

More articles/Ad

More articles

-

‘Resilient’ public sector stands ready to get back in action with dollar and euro deals

-

Focusing on absolute emissions is a big plus, said one observer

-

-

Shift to shorter Gilts as UK gets ready to borrow £304bn in 2025-26

-

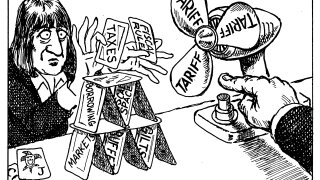

◆ Arbitrage attracts Belgium to dollars again ◆ No book updates ‘a little surprising’ and ‘a red flag’ ◆ Investors expected more spread

-

Borrowing task is second largest ever after Covid response