Top Section/Ad

Top Section/Ad

Most recent

'Hard to classify' Italian corporate trade being marketed to FIG and SSA accounts

BMW heiress Susanne Klatten exits turbine maker

Development bank's credit ratings suffered a blow after Russia's invasion of Ukraine

Another defaulter, Argentina, likely to tap market this year

More articles/Ad

More articles/Ad

More articles

-

Suriname’s outstanding 2026s traded up this week, after the government clinched $125m of short-term financing that includes coupon payment support for existing bonds and lays the ground for fiscal savings via an electricity reform.

-

Greencoat Capital, the investment manager of London listed funds Greencoat UK Wind and Greencoat Renewables plc, is eying a strong pipeline of acquisitions in the UK wind power market. However, green-hungry equity investors may have to wait a while before seeing further capital raises from the firm, its chief executive, Stephen Lilley, told GlobalCapital.

-

Environmental protection services provider Shenzhen Leoking Environmental Group has set the ball rolling for a Hong Kong listing, having filed draft documents with the bourse.

-

Despite its only previous outstanding bond trading at distressed levels and its president being sentenced to 20 years in jail for murder during the sale process, Suriname has managed to issue $125m of new amortising bonds that analysts say should be crucial for a proposed electricity reform.

-

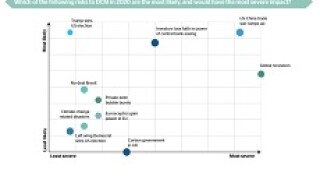

Markets go into 2020 fretting about a global recession and an escalation of tradetensions between the US and China, according to 25 heads of debt capital markets in the EMEA market, in Toby Fildes’ annual outlook survey. Respondents are mildly pessimistic on spreads and fees in the primary markets as well. But on the plus side, bankers are feeling hopeful about sustainability-themed bonds and almost unanimously believe issuance will top $270bn.

-

Franklin Roosevelt’s New Deal helped pull the US out of the Great Depression. Climate change is a bigger crisis and requires a similarly total response. But is the European Commission being ambitious enough? And will politicians, business and society accept the changes required? Jon Hay reports