Spanish Sovereign

-

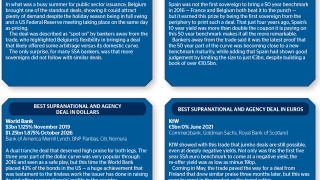

Euros in the public sector bond market have enjoyed an exceptional run throughout January, providing borrowers from all across the public sector with funding in a tremendous breadth of maturities.

-

The Principality of Asturias has become the latest Spanish region to issue bonds, rather than accepting loans from Spain's regional liquidity fund, the FLA.

-

The Spanish sovereign launched a €9bn 10 year on Tuesday, bringing the largest eurozone sovereign syndication so far this year.

-

Two more European sovereigns have hit screens with 10 year euro mandates, hoping to enjoy the same success that Portugal and Belgium with their deals at the 10 year range this year.

-

The Autonomous Community of Madrid has hit the long end of the curve with a 20 year private placement for its first deal of 2017.

-

As a year where political upsets became the norm drew to a close, GlobalCapital picks the standout trades from a turbulent 2016.

-

The European Stability Mechanism has reduced its funding needs after accepting a €1bn early loan repayment from Spain.

-

Spain has lopped €5bn off its 2016 funding programme and has applied to make a fourth early repayment of part of its loan from the European Stability Mechanism (ESM).

-

Portugal’s bond yields fell to levels last seen in early September, as investor worries eased over a vital ratings review of the sovereign by DBRS this Friday.

-

Spain has auctioned 50 year debt for the first time, wiping more than 80bp from its cost of funds compared with when it first syndicated the paper nearly six months ago.

-

Euro issuance this week is very much focused on long dated bonds, with Bank Nederlandse Gemeenten printing a 20 year syndication on Monday and other European agencies and sovereigns looking to tap the long end of the curve via auctions.

-