NatWest Markets

-

SIG Combibloc has followed Altice's recent example by demonstrating the European market’s keen appetite for large leveraged M&A deals. SIG has tightened pricing on the loans in its €2.8bn deal and replaced some of the deal's bonds with loans.

-

Santander was able to benefit from a strong bid for paper from the eurozone’s periphery this week, drawing a strong order book for a deal through its Santander Consumer Finance Subsidiary — bankers pointed to a more reassuring political situation in Greece as a reason to expect more deals from the region in the coming weeks. Meanwhile, Nordea was also able to appeal to investors with the first Scandinavian senior print of 2015.

-

The European high yield market on Tuesday keenly accepted the first triple-C rated deals of the year: a buyout financing bond from Swiss carton maker SIG Combibloc and a refinancing issue for Norske Skog, the paper company.

-

Investors shrugged off concerns about contagion to other eurozone countries from Greece’s stand-off with its creditors on Tuesday, as they flooded into Ireland’s first ever 30 year syndication. Greek yields also screamed lower during the day after its finance minister hinted that the country’s new government might not pursue a debt write-down, while fellow bail-out recipient Cyprus returned to bill auctions.

-

SIG Combibloc has followed Altice's recent example by demonstrating the European market’s keen appetite for large leveraged M&A deals. SIG has tightened pricing on the loans in its €2.8bn deal and replaced some of the deal's bonds with loans.

-

Eurozone sovereign issuers lined up to take advantage of the quantitative easing driven flattening of the euro curve on Monday, as one country the periphery mandated banks for a 30 year benchmark and another set most of its target range for an auction later this week at the long end of the curve.

-

Indonesian oil and gas company Pertamina, which is in the market for $1.8bn five year loan, has received $380m in commitments in general. Bankers on the deal said they expect to close soon with allocations likely to be out in the next couple of weeks.

-

-

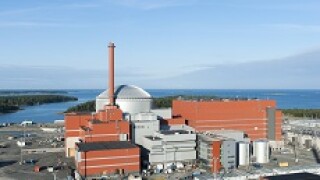

Teollisuuden Voima, the Finnish nuclear power company, priced a €500m 10 year bond on Thursday, as it brought forward its funding plans to take advantage of a European bond market energised by the prospect of quantitative easing.

-

UK online gambling business Sky Bet has widened the margin on its £340m leveraged loan by 25bp as the deal nears its deadline for commitments.

-

UK gas distribution company Southern Gas Networks issued a £350m 10 year bond on Tuesday after an investor call on Monday.

-

UK gas distribution company Southern Gas Networks has mandated four banks for its first bond since 2011. A spokesman said the company was aiming for a 10 year sterling deal, which could be priced tomorrow.