Loans and High Yield

-

The problem of ocean plastic is so daunting that it is tempting to despair, believing nothing can be done — or at least, that only the might of governments and international organisations stands a chance. A few entrepreneurs, however, are convinced this fight can become investable for mainstream capital markets.

-

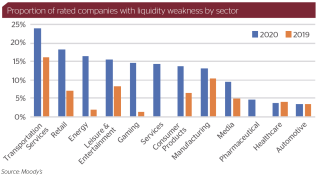

Fresh fears are rising about the future of companies already pummelled by the economic ramifications of the coronavirus pandemic. New research suggests that the worst affected industries will be the hardest hit again as Europe heads into another round of major lockdowns.

-

Outokumpu, the Finnish stainless steel maker, has extended the maturity on the bulk of its bank loans, becoming the latest company to push its debt maturities out to a time when the world economy is expected to be well into a recovery.

-

In November, GlobalCapital polled loan market participants for its 18th Syndicated Loan and Leveraged Finance Awards. The nominations are listed below, in alphabetical order. We will reveal the winners at a virtual event in February. Further details on the event will be laid out on our website in January. We congratulate the nominees.

-

In early July, a cub reporter who had only left university the year before filed a story that would cause UK fast fashion company Boohoo’s share price to tumble.

-

Trig, the London-listed renewable infrastructure investment firm, has signed a £500m loan with its margin linked to Sonia rather than Libor, as loans bankers try to encourage borrowers look at their loan documents soon to avoid bottlenecks next year.

-

Indonesian high yield companies that had limited access to the international bond market this year due to the Covid-19 pandemic are now preparing for a challenging 2021 — unless sentiment gets a dramatic boost from the vaccine news. Morgan Davis reports.

-

The coronavirus has smashed the usual hierarchy of companies, large and small, creating new winners — and many losers. While 2020 was about finding ways to keep their financial lifeblood flowing, in 2021, more permanent solutions will need to be found. This will include bond funding for those still shut out — and M&A. Mike Turner reports.

-

Corporate finance in 2020 was utterly without precedent. Never before had so many once-stable firms seen revenues evaporate instantly, with so little visibility on when the world might recover. Companies did whatever they could to hang on, pulling every lever available to source scarce cash. As 2021 begins, so will a new phase, where the fallout of the Covid rescue playbook becomes clear. Owen Sanderson reports.

-

There could be more large restructurings in Europe in 2021 than ever before, as companies seek sustainable capital structures after 2020’s rash of emergency financing. But it’s also a new horizon for the laws that govern restructuring, as countries replace a patchwork of dated and difficult insolvency regimes, and the UK exits the European Union, ending automatic recognition of its court rulings. Owen Sanderson reports.

-

This year proved to be one of the most dramatic on record for corporate financiers as volumes rose from the ashes of the market sell-off. David Rothnie examines some of the themes that defined the year and looks ahead to 2021.

-

Hot capital markets emphatically supported Casino's opportunistic refinancing this week, a deal that catapulted the troubled supermarket group back into the leveraged credit mainstream. Traditional investors and specialist hedge funds combined to allow lead banks to price the dual tranche deal through the undisturbed levels of Casino’s outstanding debt. Owen Sanderson reports.