“We have swept away regulations,” Rachel Reeves, chancellor of the exchequer, boldly proclaimed in her Mansion House speech this week, in which she outlined the government's 10-year plan for financial services regulation.

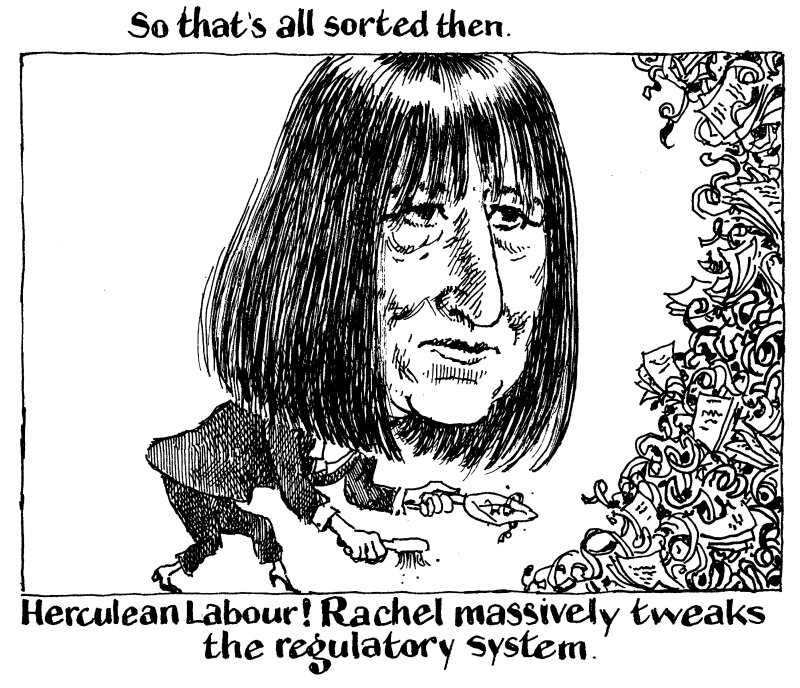

Yet the Labour government has done no such thing, nor has it announced plans to.

What it has done is propose a series of regulatory tweaks which may make London marginally more attractive for issuers and investors, in the hope this will lead to growth.

Among other reforms, Reeves is seeking to restrict the Financial Ombudsman Service's remit, to reduce the scope of the Senior Managers and Certification Regime, and shorten the time period that regulators can spend on reviews.

A number of other areas of regulation will be considered, with the outcome uncertain, including the Consumer Duty and ring-fencing regime.

While these reforms may make a minor contribution to growth if they succeed in lubricating financial flows and expanding the size of the financial sector, they are far from the extensive deregulation some had hoped for — and others feared.

Supporters of greater deregulation may yearn for a return to the glory years of the early 2000s, when the UK financial services sector grew more than twice as fast as the UK economy as a whole.

Others remember a bloated financial services sector, rampant mis-selling, and generalised hubris, and warn that Reeves' strategy will return us to unstable times.

But the reforms announced so far are simply too limited in scale for that.

They will not lead to the wholesale transformation of a post-2008 financial crisis regulatory paradigm which has proved largely effective in protecting consumers and limiting risk.

If what Reeves also said in her speech is true — that "in too many areas, regulation still acts as a boot on the neck of businesses" — then the City may be breathing a little easier this week, but it is not yet breathing freely.