Top Section/Ad

Top Section/Ad

Most recent

Record fundraising in 2025 has left private lenders fighting for deals

Best deals, banks, investors, advisers, law firms and tech providers of 2025

More articles/Ad

More articles/Ad

More articles

-

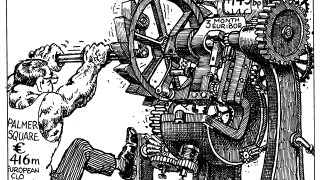

Stronger than expected loan supply and busy CLO issuance drives increase in prediction

-

First debut manager to bring a deal this year increases all tranches amid strong demand

-

CLO investors have shrugged off geopolitical concerns and are focused on rates

-

Triple-A tranches are edging tighter basis point by basis point

-

Minimising tail risk is a priority for the new manager, said Jacob Walton, co-head of euro CLOs

-

Investors shrug off geopolitical concerns after volatility