Latin America

-

Pampa Energia tapped 2034s earlier this week

-

State-owned lender continues run of Peruvian bond issues with sticky order book

-

Peruvian lender brings first non-sovereign deal from the region since April 1

-

More opportunistic equity block trades expected

-

The standout deals, issuers, banks and other market participants were crowned at a gala industry dinner in New York

-

Sovereign pays at least 25bp of concession but points to healthy demand after broader spread widening

-

Sovereign bonds have suffered a brutal eight days, like other emerging markets

-

All-in yields no higher for most in secondary as several issuers line up to follow Brazilian duo

-

AfDB's hybrid is main comparable for pricing CAF's benchmark dollar debut but roadshow feedback also holds key

-

IDB Invest backed deal comes tighter to Chilean government curve than all previous iterations as EM credit holds firm

-

Bankers say 5bp-10bp new issue concession a good result as investors stay firm on price

-

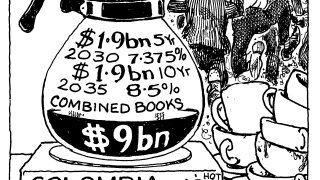

Latin American power generator to refi hybrid with seven year senior