Italy

-

After a series of wide moves from IPTs, investors were pleased a deal began close to landing

-

Belfius lands flat as Fineco prices with about 12.5bp of premium

-

◆ Senior arrives a week after €5bn book for covered deal ◆ Latest orders land at €1.4bn ◆ Rival bankers say smaller book down to smart execution, not saturation

-

◆ Deal execution is ‘exemplary of the current market’ ◆ Demand drops by around €2.4bn from peak to landing, yet clears 10bp inside fair value ◆ Issuer reduces cost with bullet and counts SP bonds towards MREL

-

SLB-only issuer defends against wider investor complaints about small penalties for missing targets

-

Constant inflows help Coca-Cola HBC, Ren and Enel snap spreads in during bookbuilding

-

◆ Deal ends with the largest book for a BPER senior trade GlobalCapital has tracked in recent years ◆ Pricing is flat if not inside FV ◆ Green deal sends encouraging signals to the periphery's other less frequent issuers

-

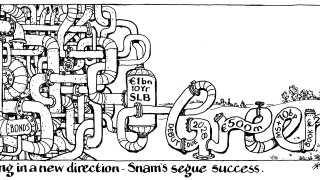

Italian gas group wins big book for debut green tranche

-

Five IPOs from the region on top of Puig and Golden Goose expected in the first half of the year

-

Italian company is latest in a string of deals to get glowing reception from deal starved market

-

Joint Lander #64 and Eurofima take euros while EBRD goes for sterling

-

Finanzagentur offers 2bp premium for investors with a 5bp concession for Greece