Goldman Sachs

-

Maker of the Wilson tennis racket files at SEC after being held up by last year’s hostile IPO conditions

-

German issuer raised a whopping €9bn while two other SSAs together grabbed €2.5bn

-

GlobalCapital is proud to introduce the Southies, the premier alternative investment banking awards for 2023

-

Discount retailer’s revenues have grown amid UK cost of living crisis

-

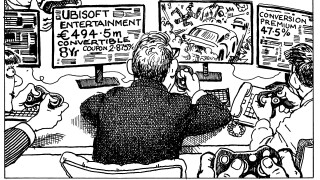

Shares in the French game publisher fell more than 8% after the convertible and delta placed

-

The trade is ‘most likely’ the final syndication this year after issuer exceeded the lower end of its targeted funding range

-

AfDB and Kommuninvest stay in the three to five year part of the curve

-

Ireland's orderly exit from AIB continues as 5% chunk sold on Monday night

-

Market shifts to favour returning issuer

-

◆ Investors primed to book US financials amid supply scarcity ◆ US banks lift $22.7bn in three days ◆ US Bancorp joins on Thursday, MUFG adds ultra-popular Yankee AT1

-

The public sector’s rush to raise dollars is set to continue on Wednesday

-

Humble teams up with Weber once more at boutique