Germany

-

German chemicals producer BASF found overwhelming demand for its first sterling corporate bond of 2018 this week. The issuer’s £250m ($330m) offering was more than six times oversubscribed on Thursday, as sterling investors clamoured for a rare non-UK credit.

-

As Brexit uncertainty kicks in, the clearing arm of German derivatives bourse Eurex has rewarded ten market participants, including HSBC and Barclays, for actively clearing interest rate swaps.

-

While borrowers crowded into the euro market on Tuesday, investors were reluctant to commit funds only two days ahead of a hotly anticipated European Central Bank meeting.

-

The Swiss listing of Klingelnberg, the German family-owned gear engineering company, got off to a flying start and was covered across its range within 24 hours of launching the deal.

-

Senior members of the legal departments at major Schuldschein arranging banks met in Frankfurt on Tuesday morning to discuss ‘baseline’ documentation for market transactions.

-

E.On has closed syndication of the €5bn loan financing for its €20.42bn takeover of Innogy, as part of the complex three-way deal between those two companies and RWE, which will reposition E.On as a distribution and supply company and RWE as a generator.

-

SSA borrowers are streaming into the euro market, flooding the early part of the week with deals in an effort to secure funding before a slew of central bank meetings towards the end of the week.

-

CreditSights, the credit research company, published a report on Thursday evening highlighting a concern about the Innogy green bond, in the context of the complex deal in which E.On is buying Innogy, while RWE buys assets from both companies.

-

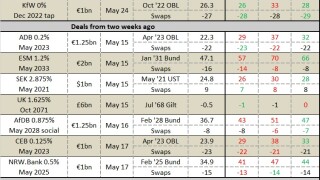

Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

DG Hyp issued a €500m nine year Pfandbrief on Friday with demand of €1bn and a concession of about 5bp. The deal follows an active week in covered bonds and comes ahead of what is likely to be another busy week before the European Central Bank meeting — partly reflecting continued execution uncertainty in the senior unsecured market.

-

-