Issues

-

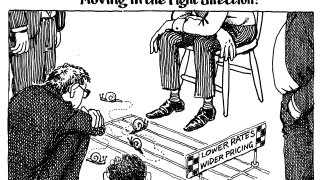

Lack of deals is keeping margins low, but volume and risk will return

-

New factors suggest bank bond issuers will find even better funding market if they wait until after Easter

-

Spreads to tighten further as yield grab drives BTPs towards pre-2008 spreads to Bunds

-

Companies can get undrawn loans at super-tight margins, drawn debt is dearer

-

Senior bankers being replaced with juniors

-

Higher than average issuance in first quarter augurs slim pickings ahead

-

‘A broad church’ of borrowers will tap the bond market as investor appetite remains red hot

-

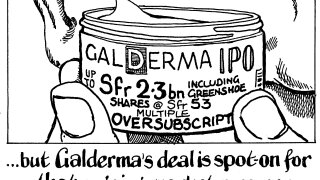

Galderma will provide the European IPO market with another important data point when it begins trading on Friday

-

Corporate supply in the first quarter of 2024 may surpass the first quarter of 2020

-

◆ US insurer’s jumbo $6bn multitrancher propels dollar FIG volume to almost $240m in the first quarter ◆ SocGen raises $1bn AT1 capital ◆ AIB reinforces Yankee issuance on Thursday

-

Michael Klein’s attempted spin-off of Credit Suisse’s investment bank was complex and conflicted, but it could have reshaped the landscape in a way the UBS takeover does not

-