Issues

-

-

Downgrade of bank’s unsecured ratings is unlikely to lead to further repricing of other German issuers’ covered bonds

-

◆ Market ‘risk-on’ after Fed meeting and surprise SNB rate cut ◆ Op Corporate Bank FRN fives times subscribed ◆ Senior sentiment unharmed by RBI’s pulled AT1

-

European bond spreads have come in from highs, but effects of Hindenburg report remain

-

-

Arms maker turns to Yankee bond market

-

Bank must accept a perfect deal may not be possible while it has Russia exposure

-

The bank was boosted by a benign Fed meeting and a successful deal from Poland this week

-

Car rental firm addresses upcoming maturity, piquing fresh bond interest among other firms

-

The German cosmetics retailer fell over 7% below its IPO price on the first day of trading

-

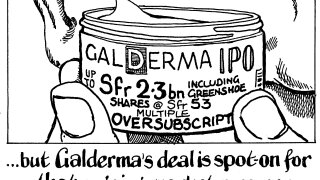

The final size of the base deal will be Sfr2bn after the IPO was priced at the top of the range

-

Central bank meetings suppress weekly covered bond volumes to their second lowest levels this year