Issues

-

-

◆ Transaction set to price through BTPs ◆ Social format offers ‘something a bit unique’ ◆ Aareal Bank joins covered pipeline

-

◆ Leads say deal landed well inside fair value ◆ Rivals say result points to ‘halcyon days’ of early 2024 ◆ Other issuers said to be eyeing Rabobank's callable FRN structure

-

‘Brave’ choice to tap the 30 year part of curve but both tranches proved a hit

-

Issuers are ‘in the mood to wait’ until after the Olympics and until there is clarity on the next government

-

Issuers both land big books as market quickly shrugs off French election volatility

-

-

Players need to play the listings game as it is, not as it should be

-

The energy firm hopes to issue new vanilla bonds in the near future

-

Hire from Bank of America helps fill gap after departure of three SSA bankers

-

◆ UK ousts Tories from power... ◆ ... setting up final round of French elections as only bar to primary market revival ◆ EM debt restructurings: balancing what creditors demand with what voters need

-

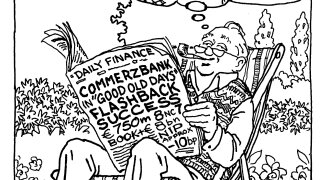

As Deutsche Bank showed this week, the long tenor trade is still on