Issues

-

Homogeneous CEEMEA issuance 'horrible' for some while others are hopeful

-

Missing US issuance could return to feed European investors ‘crying out’ for supply

-

Barclays and Citi are following rivals in scrapping the bonus cap for material risk takers in London. But after a decade of salary increases, the outcome could prove better for banks than for bankers

-

Growing disbursements drive $13bn-$15bn annual funding programme and new opportunities

-

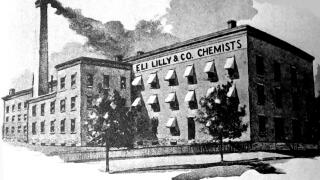

US drugmaker's multi-tranche deal kicked off a week heavily front-loaded with deals

-

Daniel Ek's investment company led the family offices that backed the deal, which demanded a 16.5% premium

-

UK lender became first Yankee bank to print a dollar trade since the end of July

-

Belief the Fed will cut rates by 25bp to 50bp in September hold firm

-

◆ UBS's recently issued AT1s have outperformed ◆ Future AT1 supply expected as capital requirements increase ◆ Analysts update performance recommendations after quarterly report

-

ESG presents a huge challenge to Asian issuers, but sustainability-linked bonds are primed to take a bigger role

-

Bankers convinced European bond markets will shrug off short term volatility around US election

-

Countries in the region are branching out from the euro market after years of low rates at home