Issues

-

CEE borrowers offering dollar deals will find good demand, says one fund manager

-

DMO has two more syndications left for this financial year

-

◆ Hamburg Commercial Bank opts for price over size and prints tight ◆ Crédito Agrícola shakes off past struggles ◆ Italian specialised government agency drastically lowers funding cost

-

UK grocer lands blowout demand in first deal from new EMTN programme

-

◆ Book falls €1.5bn from its peak ◆ Offers small pickup to SSAs ◆ Trade lands flat to fair value

-

Newly rated supermarket group receives €3bn orders for €500m deal

-

Books were over $2.5bn in the early afternoon

-

Book for its newest deal was second in size only to a QE-era transaction

-

The facility's ESG features will be finalised before the end of the year

-

As the US doubles down on oil and gas, it's time for a radical overhaul of green finance

-

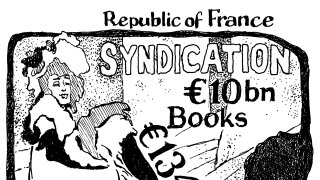

◆ Sovereign sells €10bn bond into record demand ◆ First syndication since last year’s political woes ◆ 'Strong demand for French bonds and trust from investors,' says issuer

-

Bulk of financing for sector is new money, rather than refinancing