Issues

-

DocMorris announces Sfr200m rights issue expected in May

-

Intraday alll the way as eurozone and non-eurozone covered issuers consider market

-

European capital market participants quite rightly remain unconvinced that the 90 day reprieve is anything to cheer

-

Loss of LCR eligibility could hit sterling covered demand, but issuers expected still to come

-

◆ How US tariffs will affect bond issuers in the medium and long term◆ Liberation Day: your funniest quotes ◆ A funding update from KfW's head of capital markets, Petra Wehlert

-

Bright spots in financial and corporate bond markets despite expected economic hit from escalating trade war

-

Corporates cram into dollars before tariff day

-

Next major day for US primary FIG is April 11 — JP Morgan's earnings, which typically heralds heavy new supply

-

‘Resilient’ public sector stands ready to get back in action with dollar and euro deals

-

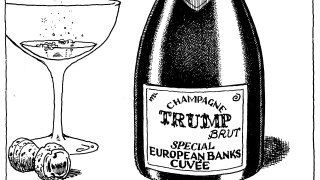

US stocks have been the big loser, while European banks could reap profits

-

-

Enthusiasm for a defence push on the continent is crucial but lacking