Issues

-

Arrival of head of new CIB will further spur NatWest Markets as broader bank looks to growth

-

◆ Assorted issuance mix mostly well taken by investors ◆ But lower yielding or unfamiliar names find it harder to gain traction ◆ Almost all issuers pay slim to single digit premium

-

Data centres face 'unquantifiable existential' risk

-

◆ OTP prints first euro covered in a decade ◆ Equitable Bank fails to tighten from IPTs ◆ Rival bankers debate Equitable struggle

-

◆ Book was one of largest ever ◆ Good window, spotted ◆ Spread versus peer made sense

-

◆ Investors scooping tier two debt across markets ◆ BNP Paribas takes advantage with third print of the year ◆ Rare German insurer Gothaer increases funding

-

◆ Old tier two call date approaches ◆ Tier two pick-up over senior gets tighter ◆ Wide range of feedback but ‘can’t compare this to anything’

-

◆ SSE brings two tranches to Orange’s one ◆ Both trades see substantial orderbook attrition ◆ Hybrids remain attractive proposition for investors

-

Medical technology company’s IPO announcement follows Autodoc’s last week

-

-

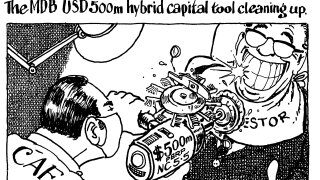

Bank intends to issue more hybrid capital but ‘more MDBs need to print’ for new asset class to grow further

-

Delayed drawdowns are more common in private credit