Issues

-

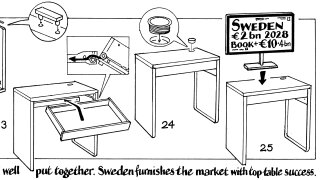

Goldman sole bookrunner as Irish state exits AIB, shareholder sells Amadeus block

-

◆ Deal attracts strong real money demand ◆ Minimal drops as accounts stick with price move ◆ Low single digit premium needed

-

◆ Hybrids fight for attention alongside SLBs and green bonds ◆ Books remain well subscribed ◆ But pressure is building for market sentiment to sharply turn

-

Black Sea Trade and Development Bank treasurer explains why now was the right time to return to raising debt

-

◆ Scarcity value draws buyers ◆ Nordic investors lured by big pickup against krona ◆ Bankers debate euro or dollar for next international bond

-

New facility replaces two loans for BBB+ rated company

-

Some thought the new issue premium was slim, but others saw it in double digits

-

Borrower monitoring market windows ahead of novel European sovereign sustainability-linked bond

-

Promoters expect new MDB to get go-ahead this year

-

More Gulf banks, outside Saudi Arabia, are preparing subordinated bond issues this month

-

Bank has raised DCM team leaders after round of departures

-

◆ Functioning market for debut and lower tier borrowers despite spike in political volatility ◆ Kommunalkredit Austria prints rare tier two as mBank prepares debut ◆ Malakoff Humanis raises €750m for growth