Free content

-

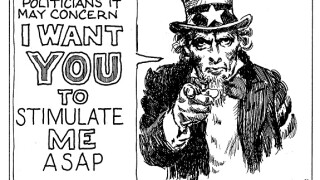

Just because it seems unlikely that in the US election the Democrats will take both the White House and the Senate, it does not mean that capital markets should become despondent about a fiscal stimulus package that could have reached $2.3tr had the so-called "blue wave" made a clean sweep.

-

Few readers of this column will have been able to avoid the temptation this week to continually hit refresh, hoping for a morsel of news on the US election. Whether you’re red, blue or polka-dot, the zig and zag of the election results has been compelling theatre.

-

Carlos ‘Sonny’ Dominguez, finance minister of the Philippines, has been forced to swap long-term planning for emergency responses to the coronavirus. He talks to GlobalCapital about what comes next.

-

China’s decision to clamp down on Ant Group has derailed an IPO of at least $34bn, despite execution being finished last week. The move appears to be little more than political muscle-flexing by Beijing. The real winners will be the country’s critics.

-

It’s a pity the irreversible damage to our world’s lungs through the wanton destruction of its rainforests does not come with the same stark health warning found on a packet of cigarettes. If it did, the world’s largest banks and asset managers might be shamed into giving up their dirty habit.

-

Quadgas, a gas asset and infrastructure investment consortium that sits above UK utility Cadent Gas, has sold $600m-equivalent of US private placements, in the first UK utility deal for more than six months.

-

Ask any debt banker in Asia about 'the Chinese bid' and they will tell you how dramatically demand from the country has transformed the dollar bond market. But a handful of recent deals from the country’s local government financing vehicles should give borrowers pause. This source of demand cannot be taken for granted.

-

Finding it hard to keep up with advances in technology these days? Citi's got just the person for you.

-

In this round-up, the Purchasing Managers’ Index reading for October points to steady recovery momentum for the Chinese economy, profitability improves at the country’s largest state-owned lenders, and Hong Kong seeks help from the World Trade Organization to ban the US’s demand for its exports to be labelled ‘made in China’.

-

This week in Keeping Tabs: the role of debt management offices in green policy, and an update on EU countries' use of capital markets.

-

In this round-up, the Chinese Communist Party has set goals for the country’s development over the next five years, regulators are ready to streamline the Shenzhen Stock Exchange, and some big property developers have been asked for their monthly financial data.

-

Take advantage of low borrowing rates to enact ambitious social programmes. That is economists' message to governments in the developed world right now. The message could also apply elsewhere.