Free content

-

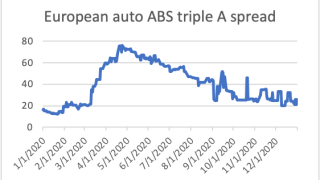

Sponsored by CSCMarket participants expect European consumer ABS spreads to remain flat or tighten in 2021, despite the potential for these deals to reflect economic stresses and rising unemployment, according to CSC and GlobalCapital’s annual securitization pulse survey.

-

Covered bonds and RMBS secured on green mortgage collateral do not deliver issuers much of a saving over conventional issuance in those markets, but favourable regulatory initiatives stand to tip the balance towards an increase in green mortgage production. Secured issuance will be the best way to fund this activity — expect green RMBS and covered bond issuance to surge.

-

Investors have shunned carbon-intensive and sin sectors this month. The message is clear: if they want to raise capital, companies in dirty industries need to show they are making meaningful moves towards becoming socially and environmentally responsible.

-

International investors are set to get their first chance to buy a carbon neutrality bond from China, with China Development Bank preparing for a deal this week. This is encouraging, and shows the country is serious about using capital markets to propel its carbon goals. But the government’s credibility will remain in doubt unless it makes changes elsewhere too.

-

Asian borrowers are showing growing interest in sealing multiple bilateral loans over syndicated deals in a bid to save time and funding costs. But while one-on-one fundraising exercises make sense in the current market environment, issuers should be wary about abandoning syndication entirely.

-

The buy-side appeared to up its ESG game this week with 35 investment firms running $8.5tr of money signing up to the Net Zero Investment Framework. Meanwhile, HSBC made changes to its own climate commitments.

-

In this round-up, Chinese premier Li Keqiang defends Beijing’s ‘above 6%’ annual GDP growth target, China’s exports soar during the first two months of the year, and the securities regulator is reportedly planning to increase scrutiny on IPOs in Shanghai’s Star market.

-

One big crisis should be enough for anyone's career. But Sir Robert Stheeman, chief executive of the UK's Debt Management Office, has had to face two monumental financial catastrophes in the last 13 years — first the 2008 UK banking crisis and then last year's pandemic.

-

Hundreds of things happened this week in sustainable finance. That’s normal now — it’s become a fizzing, global market which is ever-present. Anyone who predicted, say, four years ago that sustainable finance would take over the whole capital market probably feels the outcome has exceeded their expectations.

-

There are more risks than rewards for banks in the primary market right now.

-

I have been told that March 8 was International Women's Day. It’s a relatively new one to me, but I applaud the efforts people are making to celebrate the hardworking women in our lives.

-

The rise in US Treasury yields in reaction to the government's $1.9tr stimulus package has prompted a shift in equity markets away from highly valued tech stocks that may do less well if interest rates rise as a result of higher inflation. But if the switch means investor portfolios reflect the wider economy, that is a positive development.