-

The failure of SVB and CS were a prelude to a wider credit meltdown

-

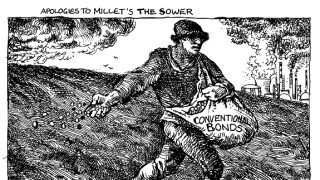

While it might not be popular with investors, longer dated paper is what covered bond funders need

-

Already comfortable with the credit? Then why not pick up exposure with some extra juice?

-

The French bank is going through the gears in debt capital markets by showing its ESG credentials, following a push across all asset classes

-

Labour: don’t change the covered regime, look to secured notes instead

-

Paying up is hard to do, but it is sometimes worth the pain to ensure funding certainty

-

-

Pulling a deal is never an easy decision, but it can be the best one

-

-

Aside from its sheer scale, the US offers strategic funding that should be seized by European banks now that the market has reopened

© 2026 GlobalCapital, Derivia Intelligence Limited, company number 15235970, 4 Bouverie Street, London, EC4Y 8AX. Part of the Delinian group. All rights reserved.

Accessibility | Terms of Use | Privacy Policy | Modern Slavery Statement | Event Participant Terms & Conditions

Cookies Settings