Top Section/Ad

Top Section/Ad

Most recent

Covered bond redemptions are set to increase by €20bn next year and €30bn in 2027

Strong demand for slim supply could tempt issuers to access the market before Christmas

No investors involved in Caffil's latest deal mentioned concerns over French risk

Issuers' desire to put covered pre-funding to one side suggests concerns over bumps ahead

More articles/Ad

More articles/Ad

More articles

-

Investors showing a preference for rarer names and jurisdictions

-

Investors are hungry for any paper offering more than 3%

-

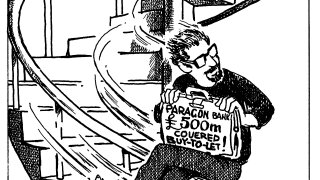

Banks have plenty of buy-to-let assets on their balance sheets; issuers should follow Paragon's lead for as long as investors and regulators allow

-

Issuers will probably have to ‘re-establish’ new issue premiums at a higher level

-

Covered and unsecured issuers await greater stability, despite positive signs in secondary

-

The issuer is also looking to end a six year absence from publicly placed RMBS