Europe

-

Chocolatier gets sticky book for first trade since S&P downgrade

-

◆ Skinny new issue premium ◆ Deal 10 times covered ◆ Pricing with EU not a challenge

-

The company is believed to have added three institutions to its lending roster of relationship banks

-

◆ Large size ◆ Pricing ‘on the money’ ◆ Getting squeezy versus OATs

-

◆ Note is the issuer’s first in euros since 2022 ◆ Slim pick-up paid over larger peers ◆ Little impact from upcoming merger

-

◆ Deal is TSB’s second in euros ◆ Minimal concession paid ◆ Bond offers single digit spread over UK peers

-

The Swiss company’s refinancing has support from more than 30 banks

-

Chocolatier includes junk rating coupon increase in marketing dual tranche euro trade

-

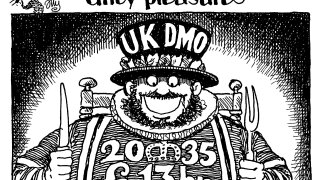

◆ Record book and deal size ◆ Investor demand 'at odds' with media headlines ◆ Key BoE actor clears up position

-

◆ Issuer initially targeted price over size but achieved both ◆ Makes sterling debuts look easy ◆ Positioning for UK membership?

-

◆ Three big SSA syndications scheduled for Tuesday ◆ EU and Italy on the same day, again ◆ UK to bring second to last syndication this FY

-

◆ 'A short story' with Saxony ◆ Book was shy of covered ◆ Pricing too tight?