Euro

-

Hopes that months of cash inflows would mitigate tariff carnage have been dashed

-

FIG issuance plans for next week in doubt after Friday 'meltdown'

-

FIG and EM cover ratios fall while other markets rise

-

‘Resilient’ public sector stands ready to get back in action with dollar and euro deals

-

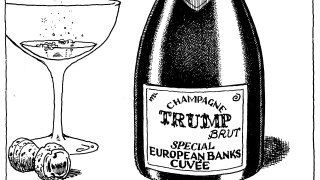

US stocks have been the big loser, while European banks could reap profits

-

Agency has funded around 50% of its €65bn-€70bn programme

-

Trading activity and primary performance show covered bond robustness

-

Issuer takes big size ahead of blackout, offering ‘right’ products to investors

-

Some borrowers eye depth of US dollar market, while others anticipate 'orderly impact' on euro spreads

-

All bonds printed this week, except Fresenius’ blowout short maturity deal, trade below water

-

◆ Finnish deal delivers size ◆ Trade already spotted tighter in secondary ◆ Finnish supply lagging 2024 year to date

-

◆ Shorter deal proves more popular ◆ Both tranches price near the same Bund spread ◆ Small pick up to Länder offered