Euro

-

◆ Well funded issuer takes aim at tight long end spreads ◆ Achieves 'very beneficial' spread even after slight premium paid ◆ Smaller size helps

-

◆ Very similar deals are priced at exactly the same spread ◆ Future supply and investor appetite direct same day execution ◆ Combined demand nears €7bn for €1.75bn new debt

-

Retail sector issuers among those eying debut deals

-

◆ Scottish utility prints eight year green bond ◆ Order book peaks at more than three times covered ◆ Small new issue premium paid

-

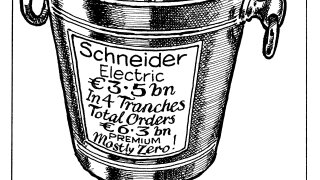

◆ French issuer prints two year floater and four, 6.5 and 12 year bonds ◆ Peak demand tops €11bn across the four tranches ◆ 12 year bond attracts the largest final book

-

◆ Softer open no problem for Dutch bank ◆ Market ready and willing to buy size ◆ Investors show large preference for one tranche over the other

-

◆ Asia Pacific pair tick investor boxes ◆ Solid demand despite tight spreads ◆ Premiums vanish in euros

-

Volume for 2025's reopening week is billions down on 2024

-

KfW's Jürging and Wehlert discuss SSA market

-

Allianz's early dollar tier one foray paves the way for tight pricing

-

Lower than expected issuance volume to keep covered spreads tight into the autumn

-

First batch of post-summer new issues flooded with demand, but will it last?