Top Section/Ad

Top Section/Ad

Most recent

Mexico paid a similar new issue premium for its $9bn deal last week

◆ What has driven this week's record issuance and what might threaten sentiment ◆ Why the Maduro affair is a wake-up call for the EU ◆ Resolving Venezuela's debtberg

New issue premiums were slim for the LatAm sovereign duo

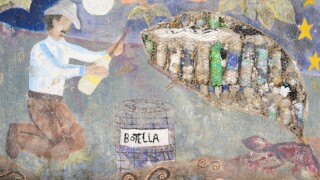

It will take years and huge amounts of money to get Venezuela in a state to restructure its debt

More articles/Ad

More articles/Ad

More articles

-

The Central American Bottling Corporation (CBC), a major bottler and distributor for drinks giants PepsiCo and AmBev, raised $200m of funding in bond markets on Tuesday in an effort to refinance debt and support its cash balance.

-

Banistmo, Panama’s second largest lender tightened pricing sharply on a seven year bond on Tuesday as bankers said the market was still in excellent shape, though others thought the bank had been too conservative with its pricing strategy.

-

In recent weeks, Argentina’s PR agency has been cramming the inboxes of financial journalists as the government goes on the attack in an apparent attempt to guilt-trip dissenting creditors into accepting its restructuring offer.

-

The Inter-American Development Bank (IADB) said on Monday that it would elect its next president virtually in September as it rescheduled its annual meetings for the second time.

-

After Argentina said on Saturday that it was looking at improving the legal — but not financial — terms of its latest exchange offer. Dissenting bondholders have united further and now say they hold more than half the sovereign’s outstanding notes.

-

Brazilian food group BRF wrapped up a now rare cash tender for existing bonds on Friday, buying back just under $300m of debt.