Top Section/Ad

Top Section/Ad

Most recent

Mexico paid a similar new issue premium for its $9bn deal last week

◆ What has driven this week's record issuance and what might threaten sentiment ◆ Why the Maduro affair is a wake-up call for the EU ◆ Resolving Venezuela's debtberg

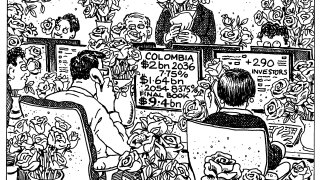

New issue premiums were slim for the LatAm sovereign duo

It will take years and huge amounts of money to get Venezuela in a state to restructure its debt

More articles/Ad

More articles/Ad

More articles

-

The terms of the tender offer are 'generous', said Tellimer

-

Sovereign authorised to issue up to $1bn but some investors still have doubts on IMF programme

-

'Stressful' Trump victory could make EM a tricky sell for fund managers, but Banorte, MSU test appetite

-

Execution impresses as sovereign found itself in sub-par market conditions

-

Spanish bank sees ‘strategic rationale’ in being in Brazil as it looks to up wholesale banking revenues

-

Colombian quasi-sovereign pays 15bp more than last week's cancelled deal, but mostly thanks to wider market