EMEA

-

Issuer finishes raising €4bn for this year after 'very different execution', with more — maybe longer — supply to come

-

Being ‘flexible and fast’ proves key for public sector issuers amid uncertain market backdrop

-

A wide spectrum of borrowers eyeing primary market after weeks of pause

-

As tariff storm eases, buyers grow more willing to move down the credit curve

-

‘A strong focus on a fast execution process’ aimed to minimise uncertainty and volatility, says sovereign’s funding head

-

The Italian gaming group has amended and extended the facility initially completed in 2023

-

◆ Bill Ackman’s firm offers chunky spread ◆ But investors only offer modest demand ◆ Company only has one other euro trade outstanding

-

The country's first election since a military coup has passed peacefully

-

◆ Larger new issue premiums required ◆ 6bp tighter than Bpifrance ◆ Size set at €2bn

-

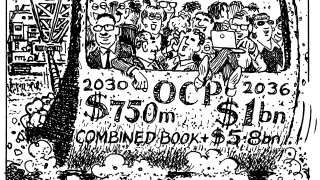

◆ Combined book one of the sovereign’s largest ◆ Swap spread volatility observed overnight ◆ Issuer ‘did well not to stretch’ the pricing

-

After soaring this month, May is expected to see new issue premiums return to next to nothing

-

M&G's hire comes amid the asset manager's push to expand loan origination capabilities in northern Europe