EMEA

-

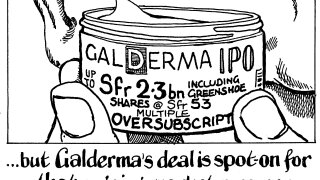

Galderma will provide the European IPO market with another important data point when it begins trading on Friday

-

-

-

Downgrade of bank’s unsecured ratings is unlikely to lead to further repricing of other German issuers’ covered bonds

-

-

Bank must accept a perfect deal may not be possible while it has Russia exposure

-

The bank was boosted by a benign Fed meeting and a successful deal from Poland this week

-

The German cosmetics retailer fell over 7% below its IPO price on the first day of trading

-

The final size of the base deal will be Sfr2bn after the IPO was priced at the top of the range

-

Equinix furore contained as others print without hassle

-

Trustpilot’s stock has gained over 107% from a year ago, although it remains well below its IPO price

-

Deal was oversubscribed with €110m of lead manager orders