Deutsche Bank

-

A year after its surprise scoop of UK equities house Numis, Deutsche Bank is making headway in the league tables

-

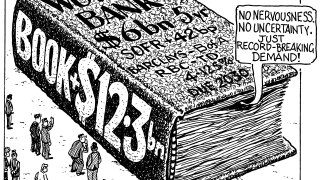

Redemptions, limited supply and a favourable rates outlook created a window for the issuer

-

Issuers stick to the Länder rule book to maximise pricing

-

Blockchain bonds are usually sold to just one or two investors in the primary market

-

Province eyes public dollars after hiatus since 2022

-

Illustrious career included 18 years at Commerzbank and seven years at Deutsche Bank

-

Hire supports BNPP's growing CEEMEA bond franchise

-

Sovereign to focus on preserving and injecting secondary liquidity next

-

Sovereign issuer passed ‘real test for investors appetite’ after returning to IG ratings status

-

Widening Bund swap spreads draws bid back to paper

-

Not all issuers drew large oversubscriptions in mixed market

-

At least four issuers will price dollar deals of between three and 10 years on Tuesday