Derivs - People and Markets

-

Barclays’s former New York head of FX trading, Robert Bogucki, was charged this week with allegedly “front-running” a £6bn options trade to be executed by technology company Hewlett-Packard in 2011.

-

Nomura has promoted several of its senior fixed income traders, giving out global responsibilities to seven individuals.

-

From February, the UK Financial Conduct Authority (FCA) might be able to ban or impose fines on anyone doing business in unregulated markets if they break codes of best practice — codes that might have been written almost anywhere or by anyone.

-

Two US senators have scolded the European Commission's efforts to unilaterally change agreed rules for the oversight of foreign clearing houses in the wake of Brexit, backing the toughening position of Commodity Futures Trading Commission chairman Christopher Giancarlo.

-

Chief executive of the International Swaps and Derivatives Association (ISDA) Scott O’Malia on Monday said that the trade body was preparing French and Irish law governed ISDA master agreements to be “ready for all eventualities” in the wake of Brexit.

-

ICBC Standard Bank has appointed Gary Simpson, a former HSBC banker, as chief operating officer of global markets, a newly created role.

-

A former interest rate derivatives trader at Royal Bank of Scotland, Neil Danziger, was fined £250,000 by the Financial Conduct Authority on Monday for allegedly trying to manipulate Libor.

-

The European Securities and Markets Authority (ESMA) on Monday issued a consultation on draft guidelines that would oblige central counterparties (CCPs) to disclose “parameters and information” on the way they calculate margin requirements for trades.

-

Arif Hussein, a former rates trader involved in the Libor rigging scandal at UBS, faced the Upper Tribunal this week to argue against his ban from working in the City, saying he had just been following orders. Following the UK’s introduction of the Senior Managers Regime in 2016, any similar scandal would play out very differently today.

-

After much heated debate, the Derivatives Service Bureau (DSB), which generates international securities identification numbers for some over the counter derivatives, seems to have successfully navigated the first week of the Markets in Financial Instruments Directive’s second coming.

-

IHS Markit on Wednesday announced that Lord Browne of Madingley and Nicoletta Giadrossi have joined as board directors of the company, while its president and COO Lance Uggla became CEO on January 1.

-

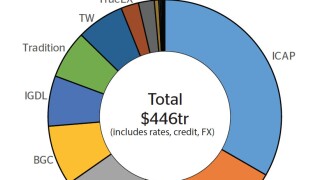

Five years after being pushed on to trading venues in the US by the Dodd-Frank Act, over-the-counter derivatives players are beating a similar path in Europe, under the Markets in Financial Instruments Directive II. Most people think MiFID II has been a worse experience, and will make it harder for small players. But efficiency gains may follow. Ross Lancaster reports.