Derivs - People and Markets

-

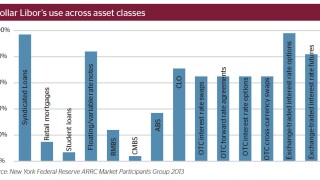

It is six months since Andrew Bailey, head of the UK financial regulator, set the clock ticking on a transition from the London interbank offered rate to an alternative. But if credible replacements are to be ready by his 2021 deadline, there is still a mountain of work to do. Ross Lancaster explores the risks of phasing out the old benchmark and asks if it could yet survive.

-

UniCredit has hired a senior Crédit Agricole banker as head of markets sales.

-

The London Stock Exchange this week reaffirmed its commitment to open access under the second Markets in Financial Instruments Directive, as major European exchanges and clearing houses (CCPs) were granted exemptions from the requirement until July 3 2020.

-

The European Securities and Markets Authority has given investment firms a six month extension to implement their legal entity identifiers requirements, but the reprieve has created a headache for the Financial Conduct Authority.

-

London Stock Exchange Group chairman Donald Brydon won a confidence vote at an extraordinary shareholder meeting on Tuesday, after an activist investor called for his sacking in November.

-

Bitcoin, the cryptocurrency that has taken capital markets by storm, may be coming to European derivatives exchange Eurex, according to a spokesperson.

-

Brokerage firm Interactive Brokers has started allowing clients to go short on Chicago Board Options Exchange bitcoin futures, requiring a margin of $40,000 per contract.

-

Crédit Agricole has added to the momentum in systematic internaliser sign up, joining other banks in registering as one well ahead of a 2018 deadline.

-

The Children’s Investment Fund, an activist shareholder of the London Stock Exchange, on Monday continued its attack on chairman Donald Brydon over the early departure of former CEO Xavier Rolet.

-

The Chicago Board Options Exchange on Monday said that it would launch bitcoin futures on December 10, more than a week ahead of competing exchange operator Chicago Mercantile Exchange Group.

-

CME Group, CBOE Futures Exchange and Cantor Exchange have all self-certified bitcoin derivatives contracts with US regulator the Commodity Futures Trading Commission.

-

The board of the London Stock Exchange Group will hold a general meeting to decide the future of chairman Donald Brydon as activist investor The Children’s Investment Master Fund (TCI) has refused to retract calls for him to be sacked.