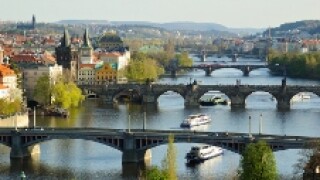

Czech Republic

-

EPIF Infrastructure, has released initial price guidance for a six year fixed rate euro benchmark.

-

Czech investment fund PPF Group has kicked off the syndication of a €3.025bn loan, which it is using to fund the acquisition of Norwegian telecoms group Telenor’s central and eastern European operations.

-

Czech investment fund PPF is in the market to syndicate a €3.025bn loan to fund the acquisition of Norwegian telecoms group Telenor’s central eastern European business. The loan is split into two term loans and a revolving credit facility.

-

Czech investment fund PPF Group has kicked off the syndication of a €3.025bn loan, which was used to fund the acquisition of Norwegian telecoms group Telenor’s central and eastern European operations.

-

UK telecoms group Virgin Media will begin marketing a jumbo loan this week, in a market that bankers describe as awash with demand. Many issuers are returning in search of tighter margins as soon as their loan terms allow.

-

Czech rental housing company Residomo is marketing a €680m seven year non-call three year senior secured bond that is expected to garner interest from global high yield accounts and emerging market investors.

-

CPI Property, a big owner of real estate in central and eastern Europe, took to euros for its first international bond on Wednesday, and in doing so priced the biggest ever real estate bond from the region.

-

The Czech Republic has proposed several legal amendments that will bring its existing covered bond regime into line with the European Banking Authority’s best practice guidelines and which, along with similar moves in Slovakia, will help catalyse new covered bond supply from the region.

-

Energy utility company EP Infrastructure (EPIF), part of the Energetický a průmyslový (EP) holding group, has refinanced a €1.75bn loan from last year with a €1.95bn facility with 15 banks making it the first Czech Republic corporate loan of 2017.

-

In this week’s round-up, the Hong Kong Exchange’s USDCNH futures record their second best trading volume on Wednesday, renminbi deposits in Hong Kong increase by 4.1% in April, and China and Germany agree to co-operate on trade and finance.

-

Legislators in the Czech Republic and Austria are in the process of updating their covered bond laws and Lithuania has set out its intention to introduce a framework.

-

Shares in Mol, the Hungarian oil and gas company, fell 3.4% early on Thursday morning but recovered to close flat, after Čez Group, the Czech electricity company, sold its whole 7.5% stake in Mol through an accelerated bookbuild, while buying back bonds it had issued that were exchangeable into Mol shares.