Currencies

-

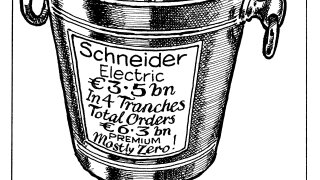

◆ French issuer prints two year floater and four, 6.5 and 12 year bonds ◆ Peak demand tops €11bn across the four tranches ◆ 12 year bond attracts the largest final book

-

◆ Softer open no problem for Dutch bank ◆ Market ready and willing to buy size ◆ Investors show large preference for one tranche over the other

-

◆ Asia Pacific pair tick investor boxes ◆ Solid demand despite tight spreads ◆ Premiums vanish in euros

-

Volume for 2025's reopening week is billions down on 2024

-

NIB's Hellerup on achieving record spread over US Treasuries

-

KfW's Jürging and Wehlert discuss SSA market

-

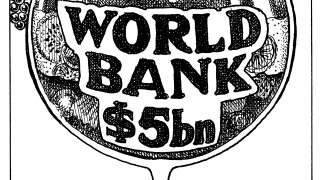

Records broken as World Bank Group issuers smash through new funding year

-

Rare green bond from Zug Estates added diversity to this week’s Swissie issuance

-

Allianz's early dollar tier one foray paves the way for tight pricing

-

Lower than expected issuance volume to keep covered spreads tight into the autumn

-

First batch of post-summer new issues flooded with demand, but will it last?

-

Diverse deals hit US market as investors look for yield pick-up across issuer types and formats